What falling retail sales means for holiday retail marketing

A falling pound, rampant inflation and a revolving door at No. 10 have created a turbulent economy in the UK. Your colleague, your boss, and even your mum are concerned about making ends meet. Unsurprisingly, the latest Retail Sales report for September 2022 shows this turmoil is impacting consumer spending as retail sales volume fell by 1.4%, meaning total retail sales volumes are at their lowest level since February 2021. They are even 1.3% below their pre-coronavirus level in February 2020.

So, as we approach a time that usually brings unrivalled consumer spending on food, decorations and family presents, how should retailers prepare ahead of a busy upcoming holiday period?

It is critical that retailers continue to invest in advertising during an economic downturn. While consumers may be spending less, they continue to buy essential categories. Retailers should tap into customer insights, adjust products to price sensitivity, optimise the customer experience and cross-sell complimentary products.

Let’s unpack some strategies for you to deploy.

The National Bureau of Economic Research (NBER) defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

We discussed how the incoming recession might impact retailers in this article.

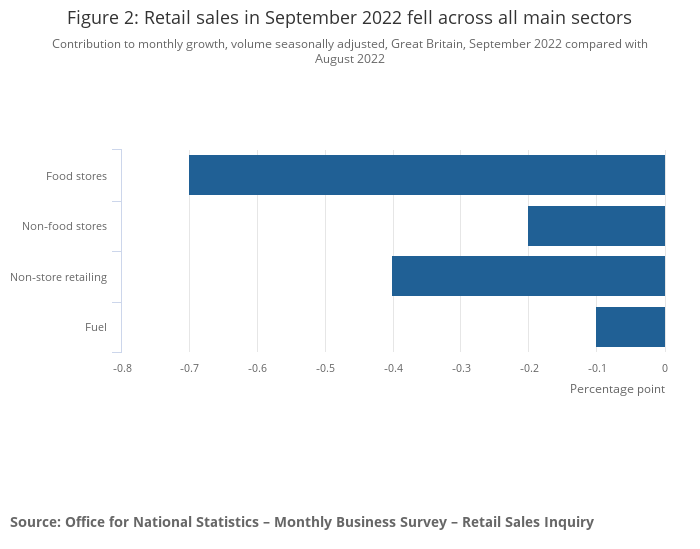

This latest ONS report on retail sales found that overall, Retail sales volumes fell by 1.4% in September. Following a downward trend over the previous 3 months, this puts total retail sales volumes at their lowest level since February 2021 and 1.3% below the pre-coronavirus level in February 2020.

And this isn’t limited to just one sector. Retail sales fell across all main sectors in September 2022. Food stores fell by the highest percentage, with supermarket retailers highlighting the increasing food prices and rising costs of living as having the biggest impact. However, every sector has been impacted. Non-store retailing (predominantly eCommerce retailers) fell significantly, but sales volumes are 18.0% above their pre-coronavirus February 2020 levels.

You can read the full ONS retail sales report here.

Overall, this continues a downward trend over the previous quarter and poses questions over the upcoming holiday season for retailers.

Will shoppers buy the same food products? Are shoppers more price-sensitive moving forwards? Will consumers spend less on gifts or buy different types of gifts?

While non-store retail is higher than 2 years ago, it’s significantly below the highs during lockdown periods. Indeed, as of February 2022, 80% of retail purchases still happen in stores.

These stats may prompt some retailers to consider downsizing or closing stores. Alternatively, you may plan to reduce investment in advertising to protect profit margins ahead of reduced income. However, history suggests this isn’t the best idea.

Global advertising agency Ogilvy released new research about advertising during a recession. Reviewing case studies over the previous 5 recessions and large and small brands, they found that brands that stopped advertising for 1 year reported a 16% loss of revenues, increasing to 57% lower revenues after 5 years. Conversely, brands that marketed aggressively during the recession reported 256% higher sales than companies that did not.

These claims are nothing new. As the report says, this type of research emerges during every economic downturn as brands look to cut costs. And history consistently repeats itself; brands that invest in marketing during economic downturns emerge favourably against competitors and enjoy boom periods post-recession.

However, it is not enough to simply throw money at the same campaigns. Brands and retailers must invest in the right areas. Investment for the sake of it could be catastrophic. It’s critical that advertising investment is well-considered and delivered in a meaningful way. Choose your investments carefully and make sure your money is being well spent.

Mass media advertising is important, but it isn’t accessible for every brand. While in-store advertising is often not discussed, it plays a critical role in the marketing mix, increasing brand awareness and a sales uplift. During the holiday period, it plays an even greater role as shoppers seek inspiration on what to buy. We further discussed the critical role of in-store advertising in this article.

During a recent announcement, Dorian Spackman, CEO of Colateral (a retail marketing software company), commented that “With the current economic uncertainty, retailers must act now to make their physical assets work harder than ever before for them. In-store marketing must evolve to give retailers and brands a competitive advantage on the high street.”

Let’s discuss how you can deploy in-store advertising during a recession.

Here’s what you can do:

Every shopper is different. Retailers and brands must tap into localised insights to identify trends in areas and tailor their marketing and merchandising to appeal to their audience.

Ensure that you are continuously monitoring information so you can adapt to trends quickly. This will ensure the advertising you invest in will make an immediate impact.

Learn how you can implement localised marketing strategies here.

Armed with your insights, don’t be afraid to make changes. Shoppers may spend less on certain categories, but it’s an opportunity to increase the number of items in the basket.

Make it easy for shoppers to find the items they want at a price-point they need. Then, implement a cross-sell strategy by placing complimentary items near essentials that can increase overall basket value.

Check out this article for a more in-depth look at the types of retail displays you might use to achieve this.

One of the biggest frustrations for marketers is the inaccurate deployment of collateral. Days and weeks are spent building out campaigns and designing great creative. But when you see it in-store, it’s clear this task was handed off to the new intern.

With rapid turnovers of displays between holiday periods, mistakes are easily made and easily missed.

Inaccurate signage, stock-outs and confusing promotions will disrupt the customer journey and impact basket value. Ensure you have visibility of campaigns in-store to avoid losing customers and leaving money on the table.

Learn how to stay on top of your in-store advertising and maintain 100% accuracy.

Regardless of mass media or digital marketing campaigns, in-store will remain a critical channel for retailers and brands. However, in-store advertising operations have remained the same for decades.

You can only improve a process for so long before you need to reinvent it. When we establish a process that works, we tend to stick with it for years, making slight improvements and refining it over time.

However, you reach a limit. A point of diminishing returns. This is a stage at which external factors outpace the minor improvements you can make to your process. We have reached this point with in-store advertising. It’s at this point that we need to reevaluate the entire process and think again.

With the rise of e-commerce, the pandemic, and economic turmoil in the market, consumer expectations and marketing capabilities have outpaced the current method for in-store advertising.

Retailers can’t continue to rely on spray and pray methods, distributing the same materials to every location, and settling for your messaging being “good enough”.

At Colateral, we propose a new way to run in-store marketing campaigns that provides complete control over asset creation and distribution. We give retailers and brands full control of which materials are distributed to each location, how it looks when implemented, and what impact it has on basket value.

In addition, Colateral facilitates mass customisation of creative materials, allowing retailers to distribute targeted messages to each location, to bridge the gap between online and in-store marketing practices.

To equip your business for the challenging times ahead, reduce costs on in-store marketing operations and deliver campaigns that drive revenues, please speak to a Colateral team member.

If you enjoyed this article and would like to learn more, please subscribe to our weekly in-store marketing newsletter.

Thought Leadership

Thought Leadership

Around in-store marketing, there is a constant debate about which is more important: Where your...

Thought Leadership

Thought Leadership

Despite the rise of e-commerce, 80% of purchases still happen in stores. And retailers produce...