What is In-store Media? And how to drive revenues from it.

Whether you are a retailer, a brand, or a grocer, in-store media is a staple of your marketing campaigns. But in the growing ether of online and e-commerce, you may question its place and whether it’s a sound investment. Indeed retail media networks online seem to be all the rage, with retailers diving head-first into the growing opportunity. However, with 80% of retail purchases still happening in-store, physical retail media can have a significant role to play. Here’s a breakdown of in-store media and how it drives revenues in your stores.

First, what is in-store media?

In-store media refers to all the displays within your physical retail environment. It serves one of 3 primary functions: wayfinding, promotion or branding. The type of media used can vary from printed signage to digital displays and pop-up experiences.

With the increase in retail media networks, grocers and large retailers are increasingly looking for ways to drive revenues from their physical stores as much as their online stores. So, can in-store media still compete?

For any company operating a physical store, in-store media is critical to your in-store marketing strategy. Any piece of in-store media should serve one of three functions:

All three functions are necessary if you operate a physical space. Indeed, a study from POPAI found that 82% of shoppers made purchasing decisions in-store, meaning that effective signage has the potential to dramatically increase your revenues.

Additionally, since the recent pandemic, shoppers want more space, one-way systems and an enjoyable shopping experience. So wayfinding signage is arguably more important than ever.

Retailers can use a wide range of types of signage to attract shoppers. Primarily, these include digital signage and print media. While there is a recent trend toward digital signage, print media still plays a crucial role for retailers.

One of the significant benefits of Digital Signage is that it is more cost-effective in the long term. However, the upfront costs to install these devices are incredibly high. Sometimes, it could take decades to pay off the initial expense. Additionally, while digital signs allow retailers to utilise a variety of more engaging content, including animation, video and moving images, these media types are more expensive and complex to create. If you need to communicate different messages daily, it may be easier for you to stick to print media or more static displays.

However, digital signage can be incredibly effective. As mentioned, moving images are far more engaging and are, therefore, likely to catch the attention of passers-by. And, if you have a simple static image display, you can simply edit the design to update them instantly.

For brands promoting their products in retail outlets, pop-ups are incredibly effective at grabbing shoppers’ attention.

We explore the different types of retail displays, the pros and cons and when to use them in this article.

Whether you use print media, digital signage, or taste-testing experiences, evaluating its effectiveness is one of the greatest challenges for in-store media. And given all the tools within your in-store marketing mix, it’s difficult to measure its impact. However, the data supports that it works.

In-store media drives revenues by directing your customers through the store and promoting relevant products and services to them at the moment of purchase. On average, 82% of shoppers make purchase decisions in stores, so effective in-store media can significantly impact revenues.

Measuring the exact impact of in-store media is challenging. However, the method we advocate for is to compare the sales performance during campaign periods vs non-campaign periods. If sales increased during this period, then it had a positive effect. And the degree to which sales increased and how effective it was. You can use this method to compare campaigns to explore which has the biggest impact.

We explore how to measure in-store advertising effectiveness in greater detail in this article.

An in-store display needs to make people take notice. On average, moving images are the best way to grab attention. In addition, designers should utilise vibrant colours, a clear message hierarchy and prominent placement to maximise effectiveness.

We’ve written a number of in-depth articles dedicated to this topic that you can access here:

For now, we’ll just summarise some of the key points here.

Targeting the right audience with the right promotion is essential. For example, suppose you run a nationwide campaign promoting your drinks brand in association with the World Cup. In that case, you will want to customise the message in England, Wales and Scotland to highlight the relevant team to each location. By tailoring your ads to your customers and delivering them to the right place, your in-store promotions will have a greater impact.

However, one of the challenges to running effective in-store campaigns is ensuring that signage is installed correctly. You might create stunning designs and plan them meticulously, but if none of the signs is installed, there will be no impact. This is where display compliance is incredibly important. By creating dynamic store profiles, allocating stock accurately and measuring your display compliance, you can ensure that your campaigns are executed flawlessly. (Here’s an article we wrote explaining how to measure display compliance).

This enables you to accurately monitor which campaigns are running in each store, measure the effectiveness of your campaigns, and implement improvements that will boost your revenues.

We couldn’t discuss the topic of in-store media without considering Retail Media Networks.

Retail media networks are a rapidly growing area of digital advertising that offer significant opportunities for both retailers and advertisers. These networks allow retailers to monetise their digital real estate by selling ad space to brands while also giving advertisers a powerful way to reach their target audiences.

Large retailers like Walmart, Target, and Amazon have already adopted retail media networks, and they have seen significant success. Walmart’s retail media network, for example, has been growing rapidly and is projected to reach $2.27 billion in revenue by the end of 2022. Meanwhile, the overall market size for retail media networks is expected to reach $160 billion by 2027.

One of the key benefits of retail media networks is their ability to provide highly targeted advertising. Retailers have access to valuable customer data, including purchase history, search behaviour, and demographics, which they can use to serve ads that are highly relevant to their audience. This not only benefits advertisers by ensuring their ads are reaching the right people but also benefits retailers by providing a better customer experience. With growing restrictions on 3rd party cookies, retail media networks give retailers the opportunity to use their 1st party data to serve targeted ads to customers.

However, if the retail media network market looks significant, consider that only a little over 20% of retail purchases take place online. Regardless of what the news tells us, physical retail remains the biggest channel for reaching customers.

There are significant challenges, however. Firstly, most retailers have limited visibility of the spaces and buyers in each location. Most organisations rely on complex spreadsheets and expensive annual retail audits to track spaces, but these are often out of date within the month. Additionally, these tools don’t lend themselves to integrating with the wealth of customer data available through loyalty cards and POS systems.

Ultimately, if you’re trying to run targeted campaigns for shoppers, you need to know who is shopping in each store and where you can place the ads. Most retailers we speak to simply don’t have that data across every location.

Digital signage companies are attempting to tackle the space mapping challenge by introducing digital shelf trackers, window displays and more. These promise more engaging displays that capture attention and the ability to quickly change what’s being shown at any time. Additionally, because they are digital, it’s easier to know where they are and manage the content that appears on each terminal. However, while digital window displays are increasingly adopted, retailers appear reluctant to implement digital displays throughout their stores, potentially due to the cost outlay involved.

At Colateral, we apply the same principle of space monetisation to in-store retail media. Importantly, we don’t rely on digital displays and enable retailers and brands to be more sophisticated with their existing fixtures and fittings and printed marketing materials.

We take a two-pronged approach.

For retailers, our store profiling software enables you to understand all of the marketing spaces in every location. This includes which spaces are occupied, how long for and by whom. Whether selling spaces to brands or running your own campaigns, Colateral gives you clear visibility of capacity so you can sell more space.

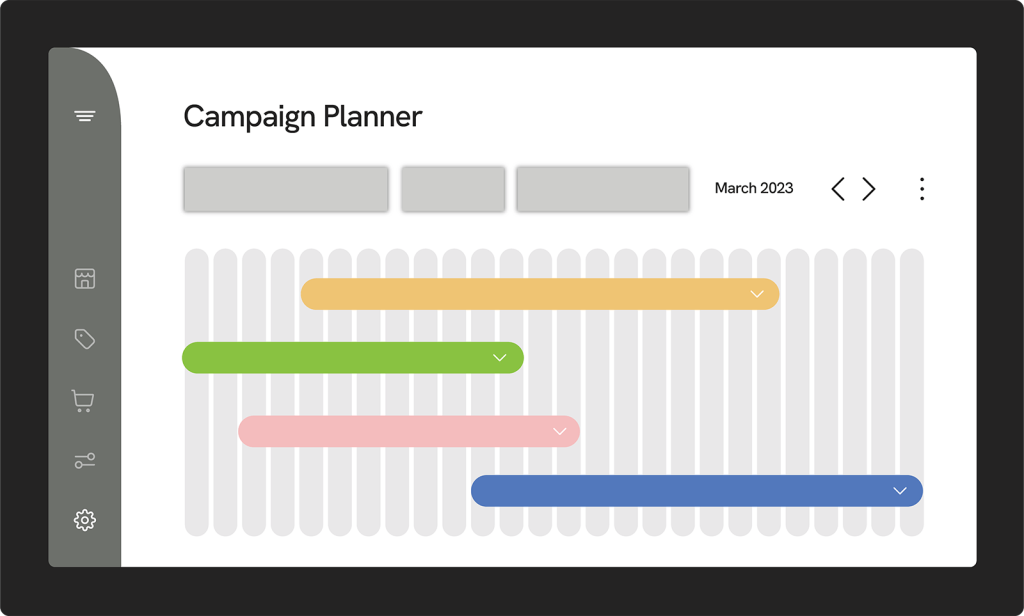

For retailers or brands running their own campaigns, Colateral gives marketers all of the tools to plan, manage and analyse campaigns from a single system.

Whether using digital signage, print or any other in-store media, you can manage the artworking process from briefing to execution, localise designs to different audiences and allocate the materials to the right stores to reach the right audience at the right time.

Learn how Colateral can help you get more from your in-store media by speaking to a member of our team.

Did you find this article helpful? Subscribe to our newsletter to receive more retail insights, tactics and strategies direct to your mailbox every week.